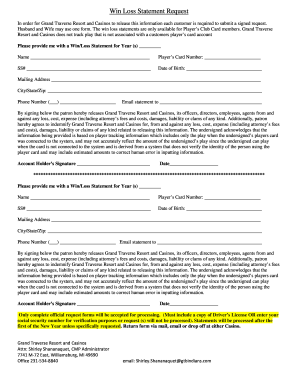

Gambling Win Loss Tax Form

Over the years, the US Tax Court has reviewed many cases when casino win/loss statements (or their equivalent) were offered into evidence by the taxpayer. None of the Tax Court judges found the documents helpful or persuasive. Lets examine each of these cases in turn.

Gambling Winnings and Losses Reporting Taxpayers must report the full amount of gambling winnings for the year on Form 1040, U.S. Individual Income Tax Return, line 21. A deduction for gambling losses for the year is allowed on Schedule A (Form 1040), Item - ized Deductions, line 28, up to the amount of winnings. File Form W-2G, Certain Gambling Winnings, to report gambling winnings and any federal income tax withheld on those winnings. The requirements for reporting and withholding depend on the type of gambling, the amount of the gambling winnings, and generally the ratio of the winnings to the wager. File Form W-2G with the IRS. Win documented on w2g is 4000.00. Win/loss over year shows a overall loss of ($1100) which would mean I won the 4000, spent it and another 1100 for an overall loss of $1100. Therefore, for federal purposes I have a 4000 win and valid 4000 loss on my tax form with the win/loss documentation to prove that.

- Amount of your gambling winnings and losses. Any information provided to you on a Form W-2G. The tool is designed for taxpayers who were U.S. Citizens or resident aliens for the entire tax year for which they're inquiring. If married, the spouse must also have been a U.S. Citizen or resident alien for the entire tax year.

- You cannot report your net winnings—that is, your winnings minus losses—on your tax form. However, you can list your gambling losses as an itemized deduction on Schedule A in order to reduce your.

Mayer v. Commissioner of Internal Revenue

On September 20, 2000, Judge Swift published the Tax Court Memorandum Opinion of Mayer v. Commissioner of Internal Revenue, T.C. Memo. 2000-295, 2000 WL 1349156 (U.S.Tax Ct.), 80 T.C.M. (CCH) 393, T.C.M. (RIA) 2000-295, 2000 RIA TC Memo 2000-295 (U.S. Tax Court 2000).

At trial, petitioner submitted an unsigned letter (a casino win/loss statement) from Caesar’s Palace that indicated the taxpayer had put $898,050 into the slot machines (“Coin-In”) and had estimated slot machine winnings of $837,570 (“Handpaid Jackpots” plus “Coin-Out”), for an estimated net gambling loss of $60,480.

However, in typical fashion, the letter included the following “disclaimer” language:

Please note the tracking system used to arrive at estimated win or loss information provides estimates only and does not constitute an accurate accounting record. * * * This information should be used as a supplement to your own records or information.

Unfortunately for the taxpayer, Judge Swift was not persuaded, and stated:

The Caesar’s Palace letter we regard as highly suspect. It is unsigned. By its terms, it is only an estimate and is to be supplemented by petitioner’s own records. We regard the letter as unreliable evidence and give it no weight.

In summary, the only evidence the taxpayer had to prove his gambling losses was a casino win/loss statement, and the Court held that it was not enough.

Lutz v. Commissioner of Internal Revenue

On April 4, 2002, Judge Thornton published the Tax Court Memorandum Opinion of Lutz v. Commissioner of Internal Revenue, T.C. Memo. 2002-89, 2002 WL 506881 (U.S.Tax Ct.), 83 T.C.M. (CCH) 1446, T.C.M. (RIA) 2002-089, 2002 RIA TC Memo 2002-089 (U.S. Tax Court 2002).

Ronald and Paula Lutz were recreational gamblers that frequently visited casinos in Louisiana and Mississippi. During 1996, they did not keep any records of their gambling activities. Instead they relied upon Trip History Reports (also known as casino win/loss statements) from the various casinos.

Prior to trial, the taxpayers and the IRS agreed upon the amount of gambling losses related to table games. Consequently, Judge Thornton was only called upon to consider the casino win/loss statements as they applied to the slot machine play of the taxpayers.

Unfortunately, the taxpayers own testimony limited the probative value of the casino win/loss statements. At trial, they testified that they considered the Player’s Card a “jinx” when playing the slot machines. In considering these documents, Judge Thornton observed:

The letters contain a number of caveats, however, including that the casino’s tracking system “is designed for marketing purposes only”, that the “information should only be used to support your personal records”, that the casino “cannot be certain that you used your * * * Player’s Club Card every time you visited us, or used it correctly”, and that “Table Game play is not an exact account of actual play; it is strictly an estimate.”

In other words, the “disclaimer” language concerned Judge Thornton greatly, and even the personal appearance at trial by the author of the letters did not relieve him of this concern. Accordingly, Judge Thornton concluded:

Gambling Winnings Tax Form 2019

[T]hat the letters are unreliable indicators of petitioners’ gambling winnings and losses, failing in particular to reflect either slot machine winnings or losses.

This lack of any credible evidence left the taxpayers with a no gambling losses whatsoever – but Judge Thornton recognized that the taxpayers had to “invest” something in order to receive these amounts. Using a payoff ratio of 20 to 1, Judge Thornton allowed the taxpayers to reduce the amount of their gambling winnings by using a “recovery of capital” rationale.

Hardwick v. Commissioner of Internal Revenue

On December 5, 2007, Judge Wherry published the Tax Court Memorandum Opinion of Hardwick v. Commissioner of Internal Revenue, T.C. Memo. 2007-359, 2007 WL 4257478 (U.S.Tax Ct.), 94 T.C.M. (CCH) 523, T.C.M. (RIA) 2007-359, 2007 RIA TC Memo 2007-359 (U.S. Tax Court 2007).

In this case, Judge Wherry provides the following definition:

A win-loss statement is generated from a Players’ Club card, which is a magnetically encoded card that patrons of a casino may use when playing slot machines. The Players’ Club card enables the casino to track a patron’s gambling activities by date and time, slot machine winnings and losses, and may provide free “comped” room, drink, and food for “high rollers”, or points that may be exchanged by the patron for food, drink, or merchandise.

In this case, the available evidence included IRS Form W2-G’s, a gambling log kept by the taxpayers, casino win/loss statements, bank statements and the taxpayers own testimony at trial.

Judge Wherry begins his analysis by reminding us that taxpayers have the burden of proving their deductions, and Section 165(d) allowing a deduction for wagering losses is no different. Next, Judge Wherry attempts to reconcile the total of all the IRS Form W2-G’s gambling winnings with the evidence offered by the taxpayers. His unsuccessful efforts, lead Judge Wherry to conclude:

Overall, there does not appear to be a correlation between the win-loss statements, petitioners’ Forms W–2G, Mr. Hardwick’s log, and petitioners’ bank account statements. Notably, the win-loss statements reflect that petitioners had gambling winnings totaling $115,142, while the Forms W–2G provide that petitioners had total gambling winnings of $322,500

In other words, Judge Wherry relied upon casino win/loss statements to impeach the credibility of the taxpayers’ other evidence. Once this was accomplished, Judge Wherry then relied upon the amount of gambling losses as determined by the IRS of gambling winnings and gambling losses suggested or agreed upon by the IRS.

Instead of using the casino win/loss statement as a shield for the taxpayers, the IRS and the Court used it as a sword against the taxpayers. This is an important lesson to remember.

Merkin v. Commissioner of Internal Revenue

Tax Form For Win Loss Gambling

On June 5, 2008, Special Trial Judge Goldberg published the Tax Court Memorandum Opinion of Merkin v. Commissioner of Internal Revenue, T.C. Memo. 2008-146, 2008 WL 2316491 (U.S.Tax Ct.), 95 T.C.M. (CCH) 1576, T.C.M. (RIA) 2008-146, 2008 RIA TC Memo 2008-146.

During the relevant time of his audit and trial, Dr. Merkin was a self-employed psychiatrist with an office on Park Avenue in New York City. In 1999, Dr. Merkin began to play video poker and spent most of his time at the Mohegan Sun Casino in Uncasvile, Connecticut.

The primary issue in his Tax Court case, was whether or not Dr. Merkin’s gambling activity allowed him to qualify as a professional gambler. Judge Goldberg held that it did not, but instead Dr. Merkin was a recreational gambler.

In conducting his analysis, Judge Goldberg relied upon the U.S. Supreme Court’s analysis in Commissioner of Internal Revenue v. Groetzinger, 480 U.S. 23, 35, 107 S.Ct. 980, 94 L.Ed.2d 25 (1987), and the nonexhaustive list of factors in Golanty v. Commissioner, 72 T.C. 411, 426, 1979 WL 3683 (1979).

Judge Goldberg immediately noticed that:

Dr. Merkin did not carry on his gambling activity in a businesslike manner. See sec. 1.183-2(b)(1), Income Tax Regs. He did not maintain any receipts, books, or records but instead relied solely upon Mohegan Sun to track all of his playing time, betting history, wins, and losses on his Player’s Club card.

Judge Goldberg then went on to use the information contained in the casino win/loss statements against the taxpayer.

For example, Dr. Merkin testified at trial that as a “professional” gambler he spent 47 out of 52 week-ends engaged in his secondary occupation for a total of at least 1,128 (assuming a minimum of 24 hours per week-end). Unfortunately for Dr. Merkin, his casino win/loss statements documented only 319 hours.

Next, Dr. Merkin argued that as a professional gambler he could demonstrate a profit motive because of all the Player’s Club points that he earned and redeemed. Unfortunately for Dr. Merkin, Judge Goldberg pointed out that:

[W]e note that petitioners failed to report as income the value of any car, airfare, or travel that they acquired from the casino in 2003.

That is certainly a big oops!

Gambling Winnings Tax Form 2018

The moral of the story is that casino win/loss statements are not the “quick-fix” panacea they appear to be, and that when dealing with the IRS there truly is no substitute for proper recordkeeping.